Fragmos Chain platform selected by Delta Capita for Post-Trade Processing of Uncleared OTC Derivatives

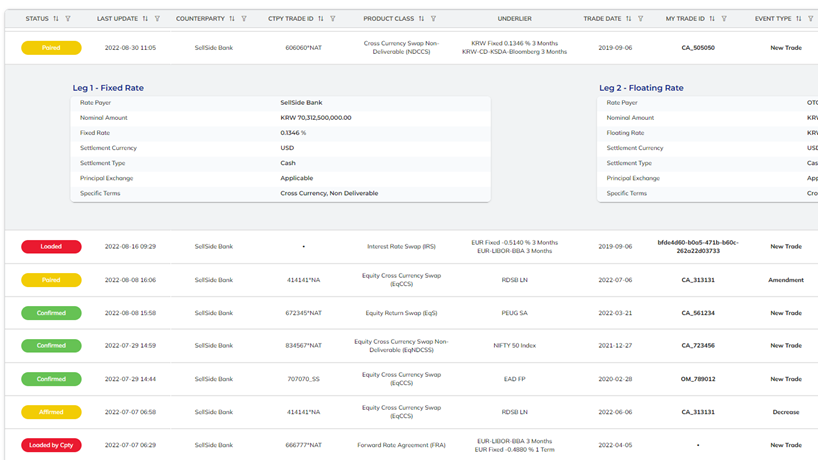

Paris and London, February 18, 2025 – Fragmos Chain, the industry digitisation platform for post-trade processing of over-the-counter (OTC) derivatives announced today that it has been selected by Delta Capita, a capital markets managed service and technology provider headquartered in London, to enhance its managed services for post-trade processing. Fragmos Chain is built upon the …