Elaris OTC: Revolutionising Derivatives Post-Trade with Delta Capita

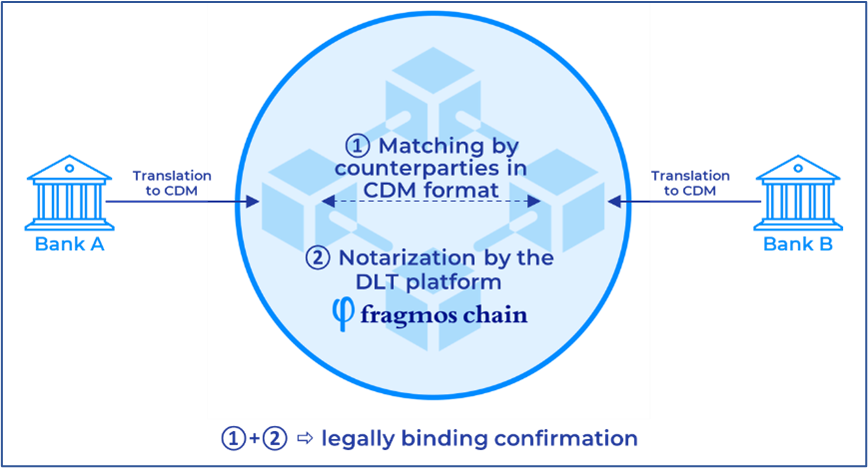

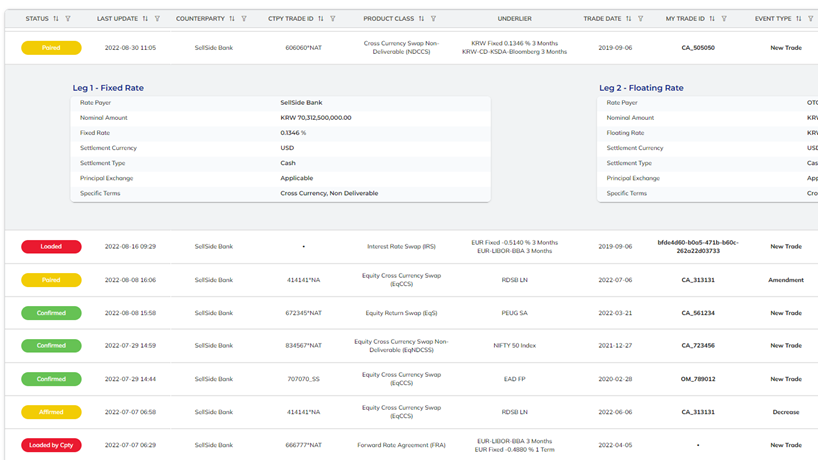

Fragmos Chain and Delta Capita launch Elaris OTC to revolutionise OTC Derivatives Post-Trade. Elaris OTC is a next-generation, fully digital, CDM-aligned solution that modernises OTC derivatives post-trade by combining best-in-class technology with proven operational expertise to set a new industry standard. Elaris enables seamless and fully automated matching of OTC derivatives trades and lifecycle events …

Elaris OTC: Revolutionising Derivatives Post-Trade with Delta Capita Read More »