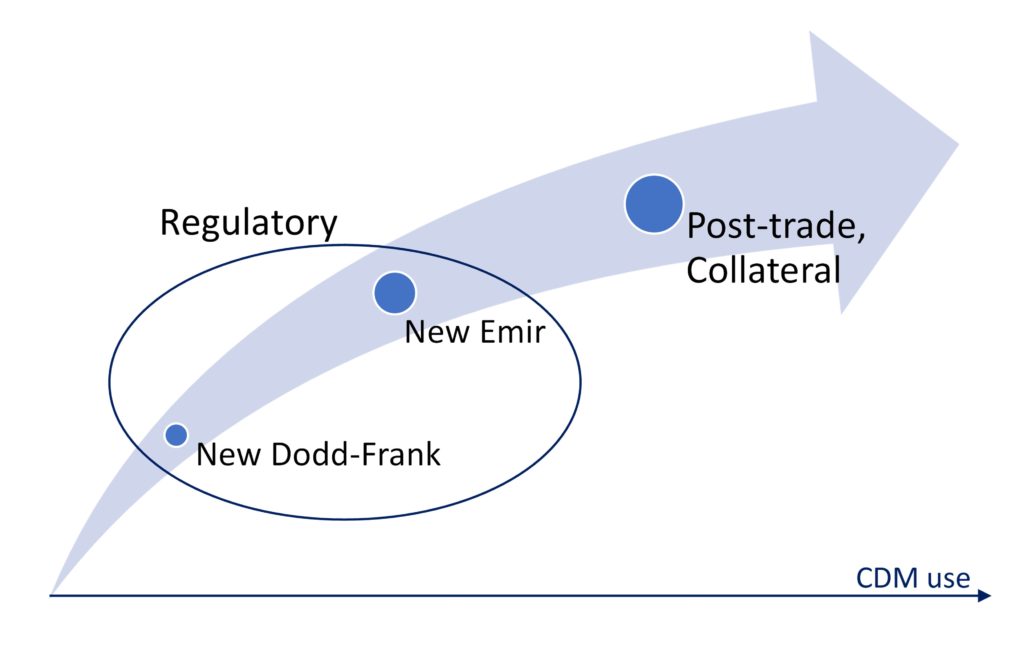

While new regulatory requirements enter into force in the coming months, ISDA Chief Executive Officer Scott O’Malia’s recent announcement shows that its Common Domain Model (CDM) is becoming central for financial firms in order to meet these requirements1. We believe this is just the prelude to an extensive overhaul of the management of OTC trades, especially collateral management and post-trade. CDM is the gateway to a world of full collaboration and optimized processes.

New regulatory reports to enter into force starting in May 2022

Based on CDM, an easy plug to post-trade platforms

The Fragmos Chain platform transforms the post-trade of OTC contracts

This is a virtuous loop. Increasingly stringent regulatory requirements demand standardisation, here CDM. And standardisation allows for a broad optimisation of processes.

(1) “The Efficient and Scalable Answer to CFTC Reporting Compliance”, ISDA, 15 November 2021, https://www.isda.org/2021/11/15/the-efficient-and-scalable-answer-to-cftc-reporting-compliance/

(2) “Certain Swap Data Repository and Data Reporting Requirements, Final Rule”, CFTC, 25 November 2020, https://www.federalregister.gov/documents/2020/11/25/2020-21570/certain-swap-data-repository-and-data-reporting-requirements

(3) “Industry Adoption Scenarios for Authoritative Data Stores using the ISDA Common Domain Model”, Barclays, 13 July 2020, https://www.fragmos-chain.comscenarios-for-industry-adoption-of-the-isda-common-domain-model/