The Bank of England published on 2nd June 2020 a report on “The Future of Post-Trade Findings from the Post-Trade Technology Market Practitioner Panel”.

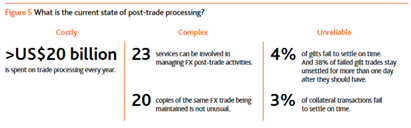

The next move for banks is now digitalizing post-trade processes. Findings are self-explanatory:

Post-trade processes, both within and across firms, have evolved organically over time, with layers of legacy technology systems, infrastructures, and workflows. The resulting patchwork, while functional, is complex, costly and inefficient — which impacts operational resilience.

As just one example, data are not always standardised and are held in multiple systems that may require constant reconciliation, raising costs and the chance of errors. Taken together across the trade life cycle, across all asset classes, and across all firms, the inefficiencies in post-trade processes present both a significant opportunity for change, and a source of systemic risk.

The Panel identified a number of particularly time consuming, costly, or unreliable aspects of post‑trade processes (‘pinch points’): …

• Trade enrichment — information beyond material economic trade data are not exchanged early enough in the trade life cycle and may be inaccurate, incomplete or not standardised, leading to the need to ‘enrich’ trade data through subsequent interventions.

• Internal and external data reconciliation — multiple copies of the same trade data are maintained (inconsistently) across firms, and automated interfaces for data exchange are underdeveloped. This holds back automation, resulting in duplicated processes, and increases operational and cyber-risks.

• Handling trade errors, exceptions, and breaks — lack of consistent protocols and procedures makes diagnosing and resolving errors time consuming and resource intensive.

• Processing corporate actions (eg share splits, mergers) and derivative life‑cycle events (eg novation, fee payments) — requires manual overrides and checks, and can be vulnerable to errors.

Costs are excessively high: